Best of breed tools give you the insights and information you need while helping you stay connected with your

Moors & Cabot financial professional.

Secure meetings with your financial professional.

Anytime, from anywhere.

Not just for times like these.

At Moors & Cabot, the relationship between a client and financial professional is at the heart of everything we do.

It is especially true now, during such a volatile time, when we know that you do not have the ability to meet with your financial professional in person. That is why we have partnered with Google, a market leader in business collaboration, to give you access to your financial professional, even when you are miles away.

These rich video meetings need nothing more than a computer or mobile device with an Internet connection. There is nothing to install and only one link to click.

Are you local to your financial professional, but your spouse or business partner is traveling? While temporarily suspended, under normal circumstances, you can come into a Moors & Cabot branch and use one of our immersive video rooms.

This creates a more intimate and productive session, even when you include participants from far away.

Award Winning Online Access

Go beyond investment balances and performance. See your accounts holistically, including your current risk score and alignment to your plan, and share visibility of accounts you have with other institutions with your financial professional. Stay on top of your entire investment portfolio, the markets, and the economy. You will receive a common experience across desktop, tablet, and mobile.

Features include:

-

Brokerage overview that consolidates portfolio information

-

Quick access to watch list, market updates, and contact information

-

Link and share visibility to all your accounts, even those not held at M&C

-

Real-time, easily refreshed quotes; includes predictive search

-

Research center that aggregates news, research, and independent analysis

Capabilities shown provided by RBC Clearing Services and the RBC BLACK ©.

RBC Black: You and Your Financial Professional Focused on

Your Complete Financial Picture, Health, and Wellness

Risk and volatility. Confidence in reaching your goals. Exposure and allocation across all of your investments. A complete view of your holistic financial life.

RBC Black brings together best-of-breed vendors in planning, risk scoring, and aggregation.

-

Allow your financial professional to see investments and accounts you have outside of Moors & Cabot.

-

Play with factors that may change your plan, such as when and how much income you would want in retirement, new goals, and changes to expenses.

-

Compare your desired investment risk objectives with your current investments.

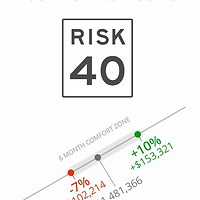

Riskalyze: What's Your Risk Score?

Riskalyze can tell you how sensitive your investments may be to changes in the market. You may be surprised as to your true risk tolerance.

You can view the potential upside and downside risk of your portfolio and work with your financial professional to re-align your investments to your desired risk tolerance.

When you aren't afraid to talk about risk, your financial professional can be empowered to make better decisions.

MoneyGuide: Everyone Needs and Deserves a Quality Financial Plan

A MoneyGuide Financial Plan is a collaborative and living financial plan. It's more

than a snapshot in time—it's the common and shared blueprint for you and your financial professional.

Sometimes, one of the biggest challenges with a plan is knowing what you want (individually or with a spouse/partner). MoneyGuide Plans "break down" what can be the overwhelming into manageable focus areas, using short videos, questionnaires, and even games.

Further, our plans replace guesswork for estimating what your future costs may be with big data. By using these aggregate values and analyzing trends, your plan can estimate what costs for things like health and childcare are now and what they are likely to be in the future.

And, if you want to see "what-if", there's the Play Zone. See the effect of a change such as a job change, early retirement, or living longer.

Looking for Mobile-Friendly Account Access?

Yeah, We Have Apps for That

RBC Connect

You have secure access your Moors & Cabot accounts on the go. Use TouchID and FaceID (compatible device required).

See your investment performance, activities, and holdings; make mobile deposits for free; and transfer funds between accounts.

This application requires registration with InvestorConnect.

CircleBlack (for clients enabled with RBC Black)

If your financial professional chooses to share the CircleBlack app with you, you will gain additional features to share some/all accounts you have outside those at Moors & Cabot with them.

You can see your total net worth, allocation of investments across asset classes, overall performance, and alerts relevant to your investments.